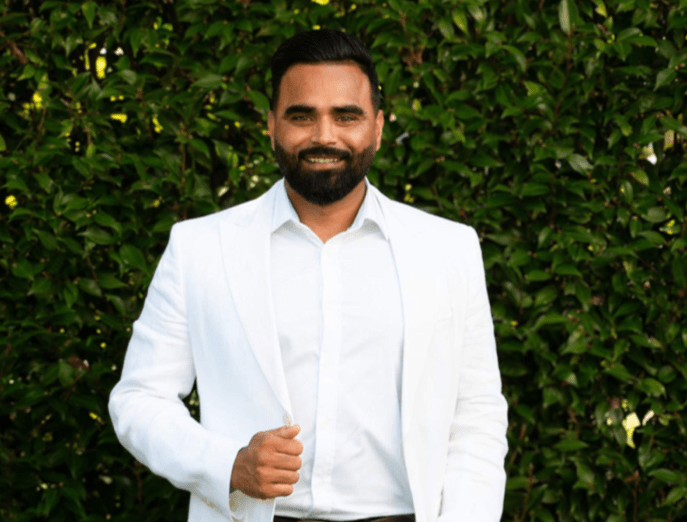

Your Go-To Waikato Insurance Broker Wayne Cooney talks Professional Indemnity Cover

Disclaimer: This is just a ‘General Guide only’ and must not be deemed to be ‘Financial Advice’ in any form. Please Contact your Insurance Adviser for any appropriate financial advice accordingly.

A Professional Indemnity (PI) insurance policy covers a range of scenarios, including claims of services and advice received from the professional that result in a client with a financial loss. Professionals who can benefit from PI insurance include Personal Trainers, Physio’s, OT’s, IT Consultants/Specialists, Web designers, Architects, Engineers, Media Consultants, Business Coaches, Mortgage Brokers, Real Estate agents and the list goes on. These individuals or companies possess the necessary qualifications and expertise to offer specialized services in their respective fields, usually at a cost.

PI insurance is a vital safeguard for professionals who provide specialized services or advice in various fields. This type of insurance is designed to protect insured individuals or companies by offering coverage for costs and expenses acquired for defending claims, and any damages or charges that may be bestowed on them. PI insurance ensures that professionals are shielded from potential financial liabilities.

By having PI insurance, professionals can mitigate the financial risks associated with these claims. If the insured professional is found liable for damages or costs, the policy can also provide compensation for such expenses.

There are several types of PI claims that professionals may encounter. A couple of common claims are a breach of contract and a breach of confidentiality, where a client’s specified confidential information is given out. Another claim involves infringement of patents or copyrights, which can result in significant legal and financial consequences.

Additionally, professionals can face claims for failing to meet the level of skill and care expected in their profession.

Ultimately, professional indemnity insurance acts as a safety net for professionals, ensuring that they can confidently deliver their services without fear of crippling financial repercussions. It provides peace of mind for both the insured professional and their clients, knowing that any potential losses resulting from services or advice will be adequately covered. As the business landscape becomes increasingly complex, PI insurance remains a fundamental aspect of risk management for professionals in various fields.

Do you know if you need Professional Indemnity Cover? Give Wayne Cooney your go-to insurance broker a call for a free quote or review today!

Contact Wayne Cooney

021 347 640

www.waynecooneyinsurancebroker.co.nz

facebook.com/waynecooneyinsurancebroker

Contact Phillip Quay

027 458 7724

facebook.com/nzbusinessconnect