Unlocking Wealth and Stability: The Compelling Benefits of Investing in Property Today

UK Correspondent: Peter Minkoff

Property investment has long been seen as a reliable and successful endeavor, and in the modern, constantly changing financial environment, it is still a good choice for people looking to accumulate money and guarantee their financial future. Beyond monetary profits, purchasing real estate offers investors a number of perks that make it a desirable choice. The key advantages of investing in the housing market will be discussed in this article.

Long-Term Appreciation

The possibility for long-term growth is one advantage of real estate investing. Real estate has typically demonstrated consistent growth over time, unlike other investment options that could be vulnerable to erratic market situations. Over time, house prices often increase, enabling investors to develop equity and amass riches. For individuals who keep their properties for a long time, this appreciation can be extremely satisfying because it allows them to leverage their investments for future financial rewards. Further, factors including population expansion, urbanization, and rising housing demand frequently contribute to long-term appreciation.

Passive Income Generation

Property ownership provides the chance to produce passive income through rental returns. Investors can generate a dependable income stream that can replace their current wages totally or boost them by buying a property and renting it out to renters. Rental revenue generates dependable cash flow, particularly in areas where rental property demand is high. Investors can also maximize profits and their potential for cash flow by carefully managing their properties and analyzing the rental market. This passive income can offer monetary security and flexibility, enabling people to pursue other endeavors or take pleasure in a comfortable retirement.

Popularity of High-End Properties

In recent years, there has been a growing interest in high-end properties, with investors seeking attractive luxury apartments in Boston and other desirable locations. These opulent homes include a variety of amenities, exquisite finishing, and desirable locations, making them very alluring to wealthy buyers and real estate investors searching for top-notch homes. For investors seeking both luxury and a steady return on their investment, high-end homes are a popular alternative due to their history of great long-term value increase. People looking for exceptional living experiences and the chance to make significant financial gains are the main drivers of demand for these flats.

Portfolio Diversification

A key component of investment strategy is diversification, and purchasing real estate offers a fantastic opportunity to do so. You can diversify the risk among several asset classes by including housing as part of your investing portfolio. Property is a useful hedge against market fluctuations because it traditionally has little correlation with other financial assets like equities and bonds. A well-diversified portfolio that incorporates real estate can help investors minimize overall risk and increase the stability of their investment holdings. Additionally, portfolio diversification through housing can offer a physical asset that boosts an investment strategy’s stability and robustness.

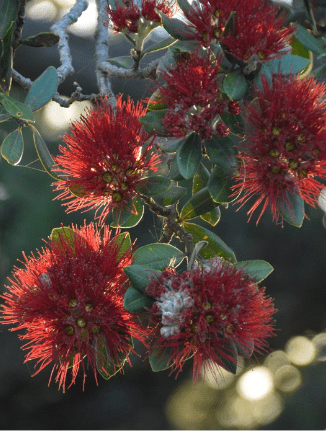

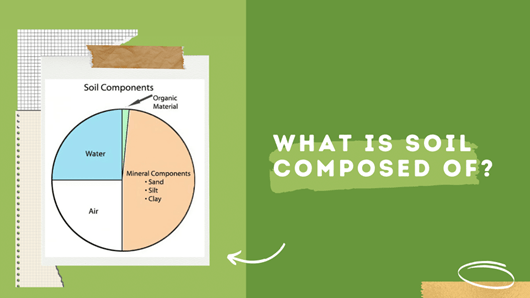

Stability and Tangible Assets

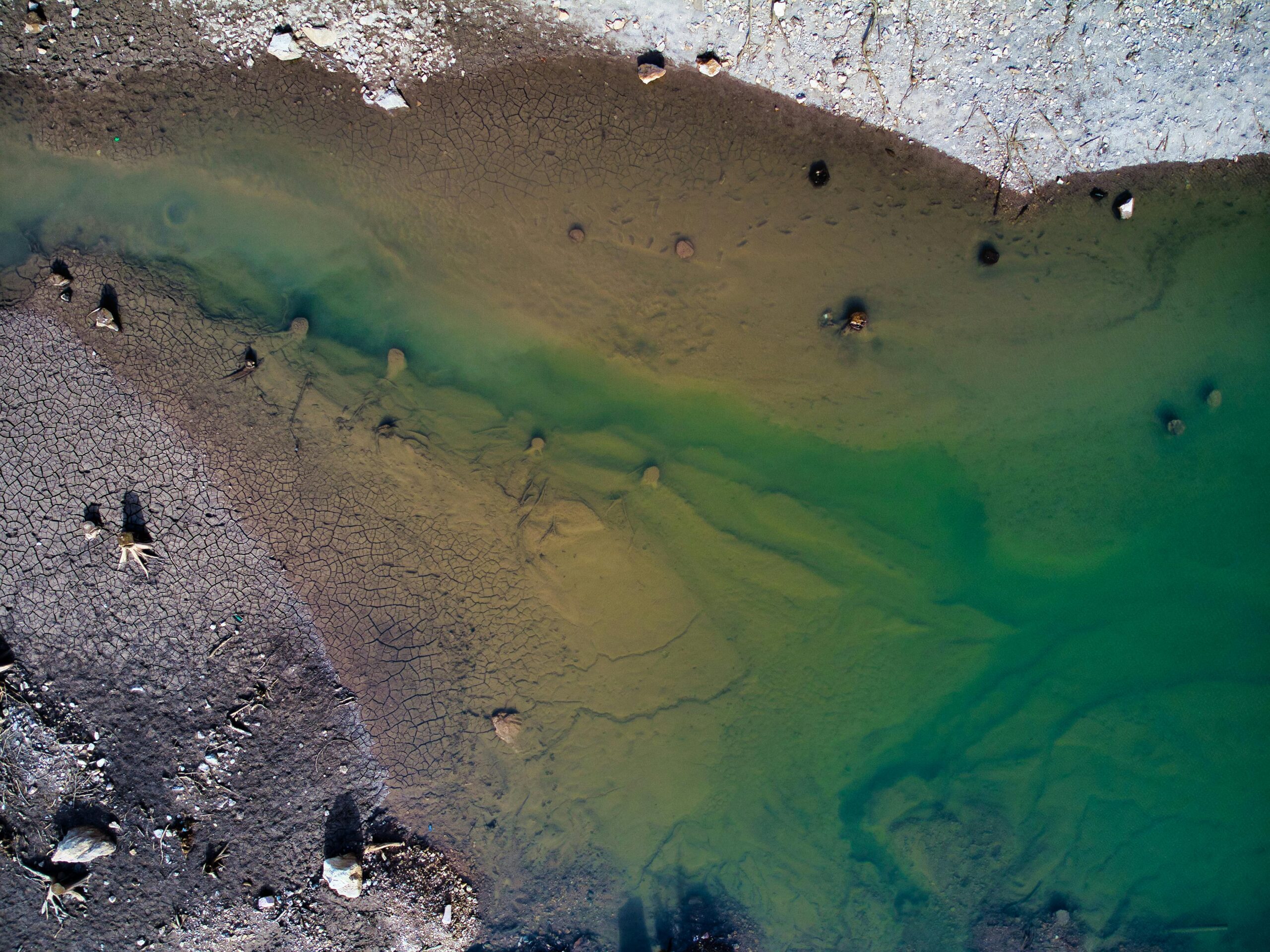

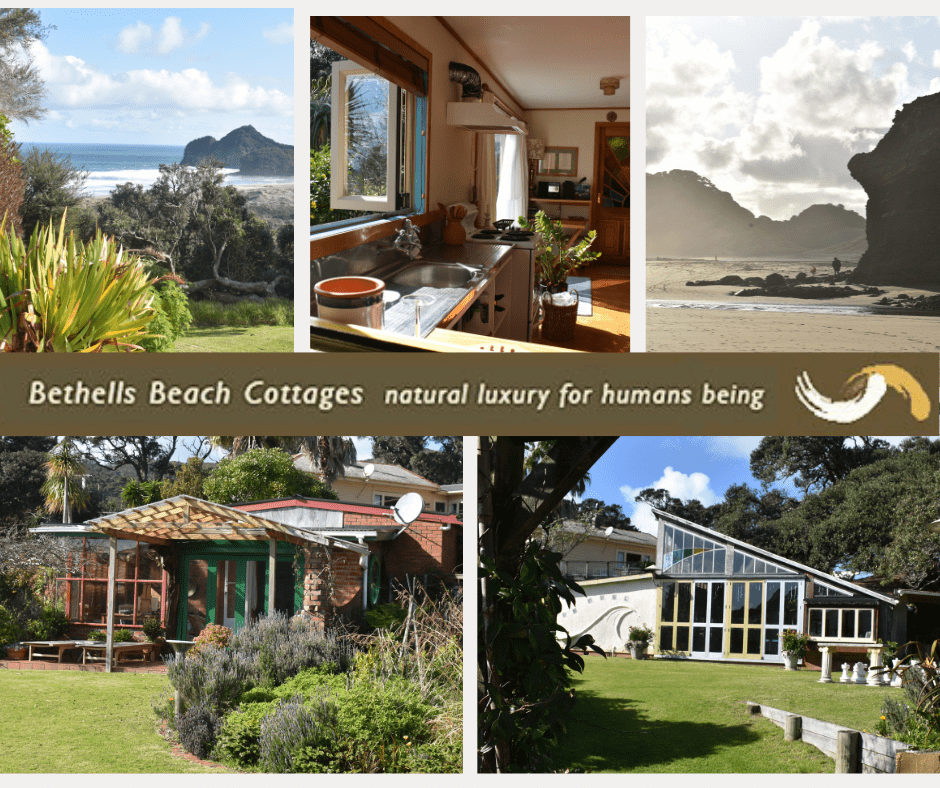

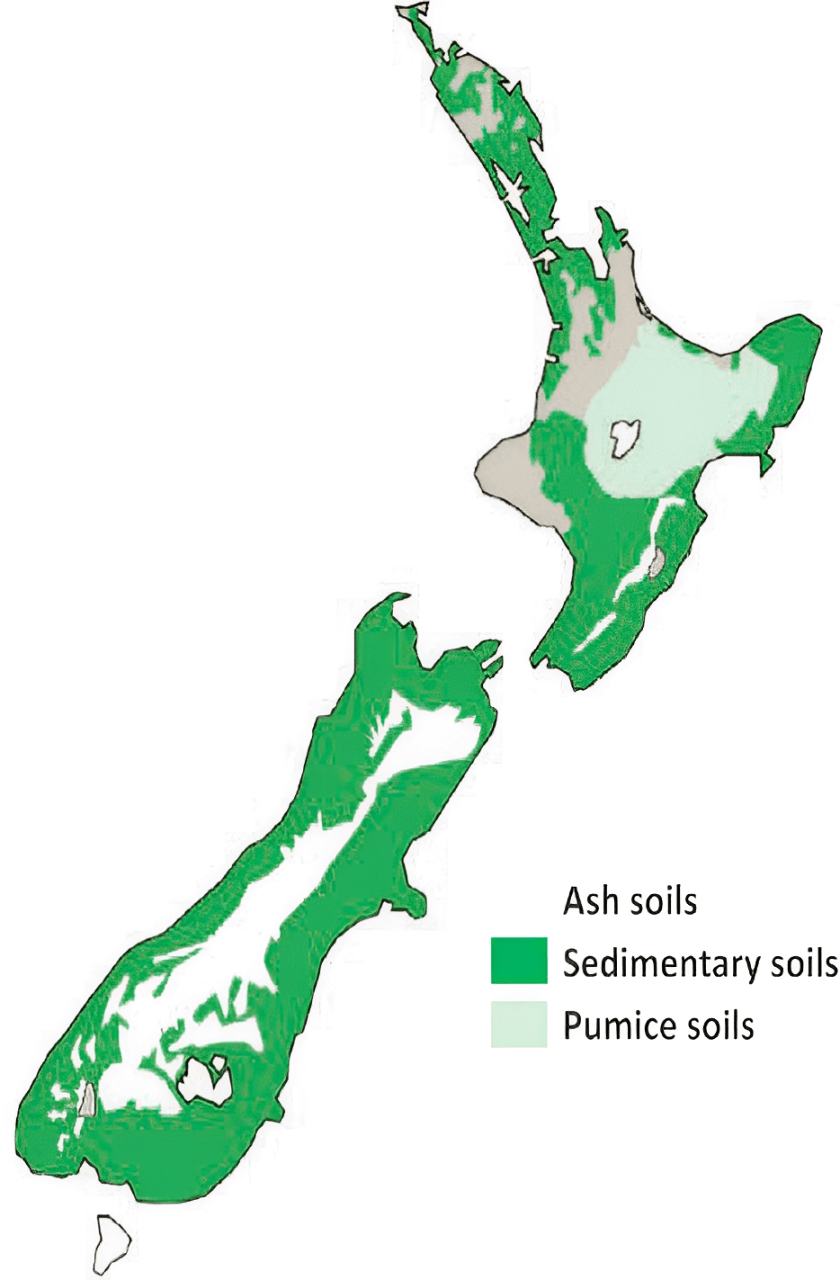

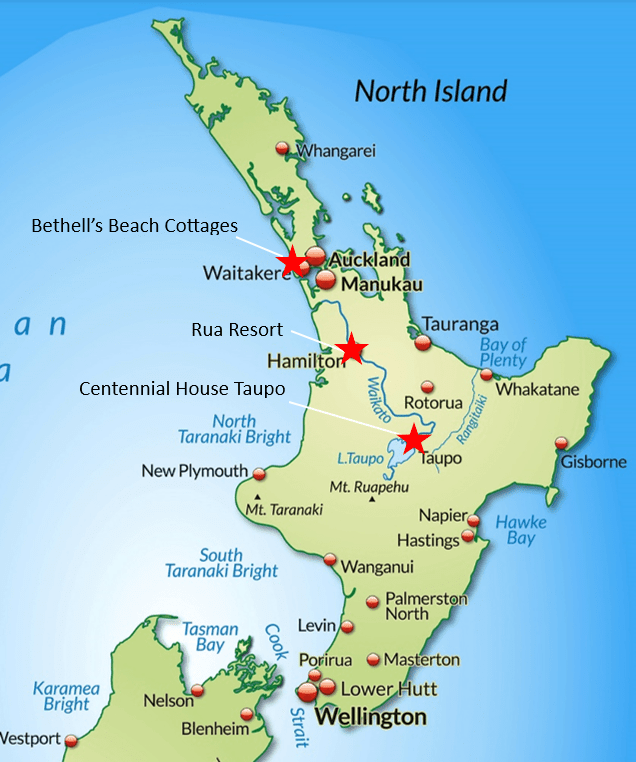

Investments in real estate provide a level of stability that other financial options might not. Investments in the stock market and other financial sectors, which can be susceptible to volatility and unpredictability, tend to be less resilient than purchases of real estate. A tangible asset like real estate gives investors a sense of security and control. Property investments enable people to have a real asset they can monitor, manage, and possibly develop through modifications or renovations, in contrast to stocks or bonds that only exist as virtual representations. Housing investments provide a level of security and satisfaction that other investments might not be able to, especially in stable markets such as New Zealand.

A property full of potential in New Zealand with heaps of room to grow, 1093 Tairua Whitianga Road, Whenuakite, Coromandel-Thames.

In conclusion, those seeking to increase their wealth and safeguard their financial future continue to find real estate investing to be a desirable option. Whether an investor chooses to invest in residential, commercial, or high-end real estate, property is still a reliable and profitable asset class that offers many advantages to those prepared to take on some risk.

Contact Phillip Quay

Email: Phillip@mediapa.co.nz

Mobile: 027 458 7724

facebook.com/nzbusinessconnect