Drumm Nevatt & Associates, Tauranga, Auckland – Tax Compliance

Tax Compliance – a taxpayer complies (or fails to comply) with the tax rules.

- By declaring income

- Filing a return

- Paying tax due promptly

Tax Obligations – Filing in a cost-effective timeframe

Governments are increasingly putting pressure on tax administrations – our global economic environment has resulted in businesses facing challenging times in managing tax compliance.

Why is tax compliance important?

Failure to file returns and report income and transactions subject to tax is likewise punishable by law.

Tax compliance has three dimensions – filing, payment, and reporting.

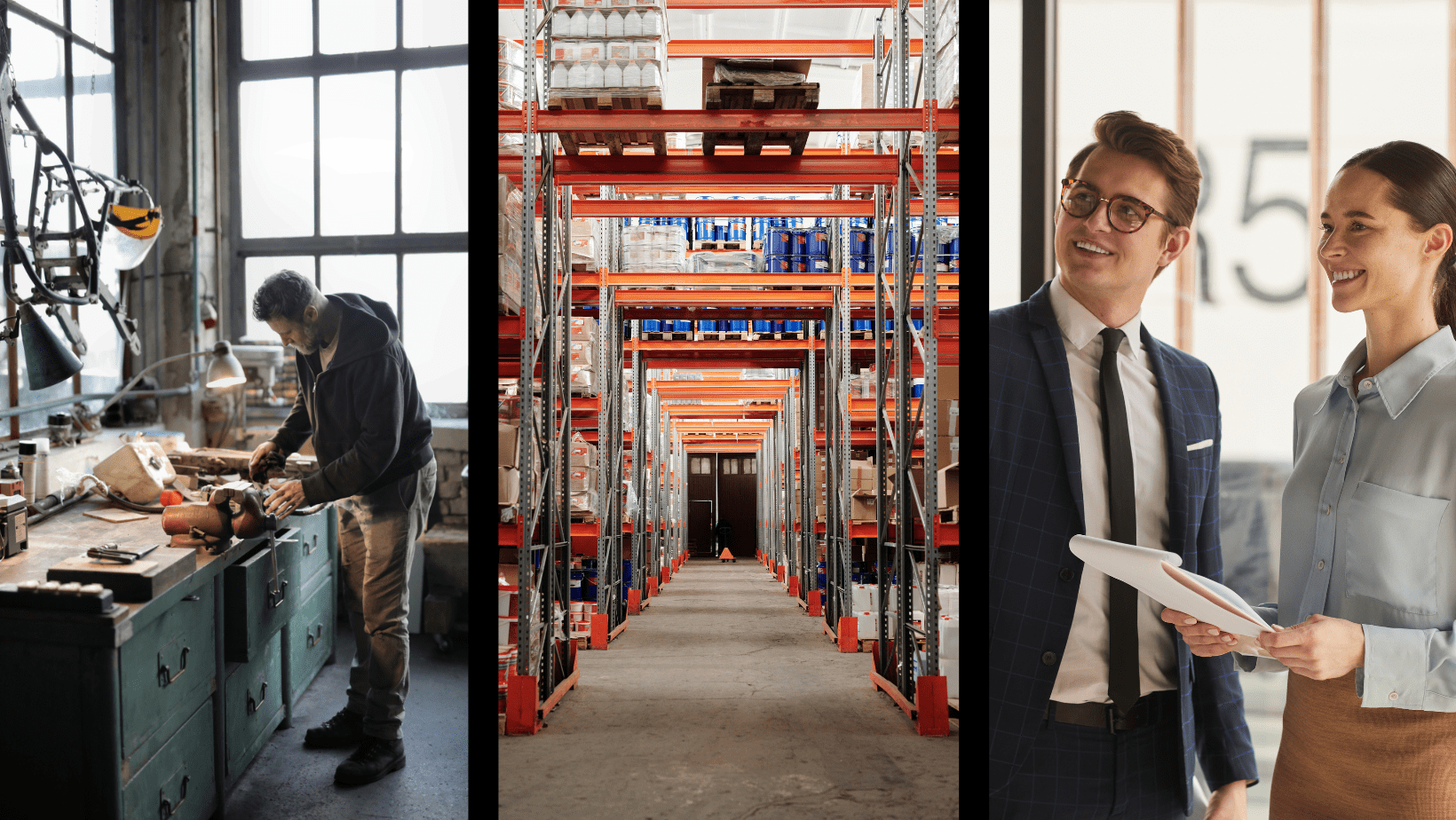

What does compliance mean in the workplace?

- Workplace compliance means complying with local laws and regulations.

- Every business, respective of size, must adhere to compliance regulations. They must also meet specific mandates for data security, privacy, and workplace security.

- You won’t necessarily have to pay all the different taxes.

- What you pay and when you pay are dependent on your earnings. Your

business structure and whether or not you have employees are also factors. - You will be required to pay some taxes yourself and some for your business. If you have employees, you’ll collect and pass on some taxes on their behalf.

Everyone who earns money in New Zealand must pay income tax, including:

- Businesses

- Contractors

- Self-employed

Taxable income can come from various sources, including:

- Wages

- Salary

- Profit

- Interest payments

- Dividends

If you are a:

- A sole trader, you file an individual income tax return (IR3)

- In a partnership, each partner needs to file their return, and your business needs to file two income tax returns (IR7)

- Set up as a company, your business needs to file a company’s income tax return (IR4).

Ignorance in failure to pay taxes on time will have consequences – it is your duty as a taxpayer to educate yourself on all tax obligations you must fulfil on time.

Tax compliance can be challenging for small business owners, and requires a thorough knowledge of various tax laws – it also involves much time and follow-up work. In addition, deadlines are crucial and must meet with accuracy.

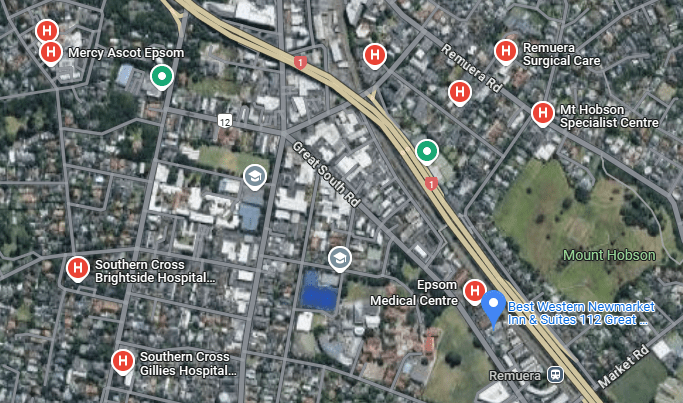

The Drumm Nevatt & Associates team are professional, highly skilled Chartered Accountants based in Tauranga and Auckland.

They can provide help with all your tax accounting services, including annual accounts, GST legislation, tax facts, tax legislation changes and critical dates. The knowledgeable and experienced accounting team will provide tailored advice and firm solutions to help your business get the best results and ensure you only pay as much tax as you need.

Are you ready to talk to an exceptional and professional accountancy firm about your business financial needs? Then let’s chat.

Drumm Nevatt and Associates Limited

Howick Office

E: office@dnaca.co.nz

Ridge House

69 Ridge Road

Howick

Auckland 2014

PO Box 54 060

The Marina

Auckland 2144

Tauranga Office

P: +64 7 576 2194

E: admin@dnaca.co.nz

23 Myres Street

Otumoetai

Tauranga 3110