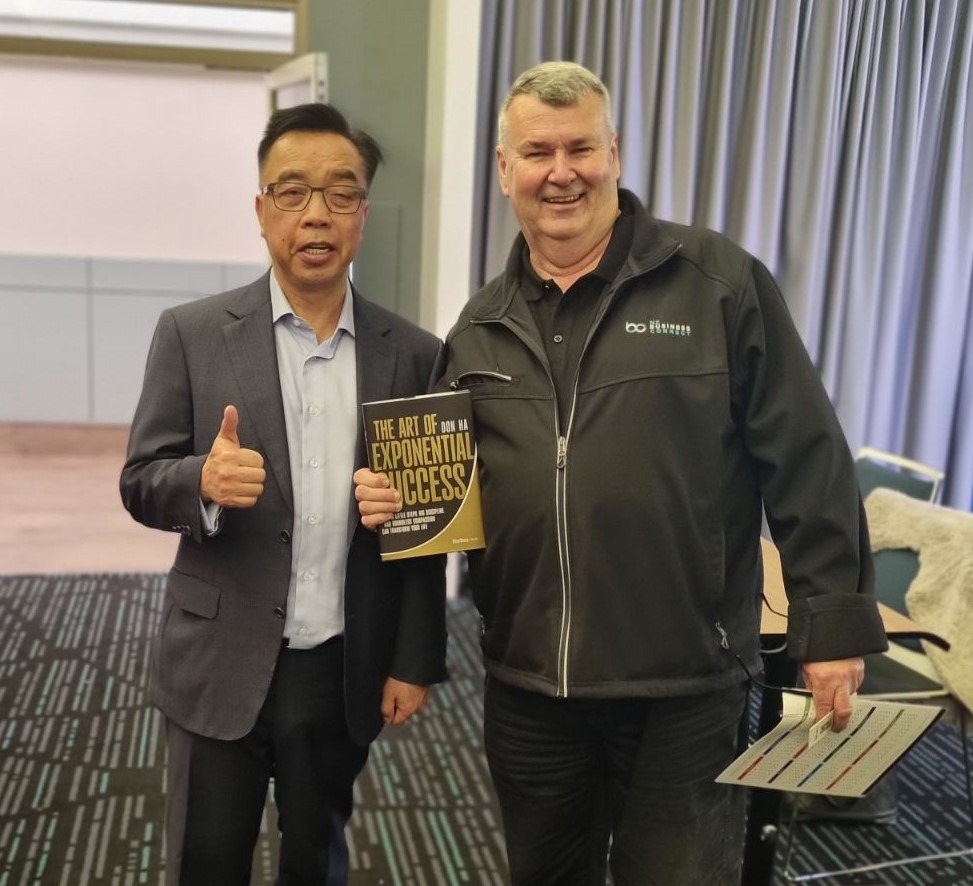

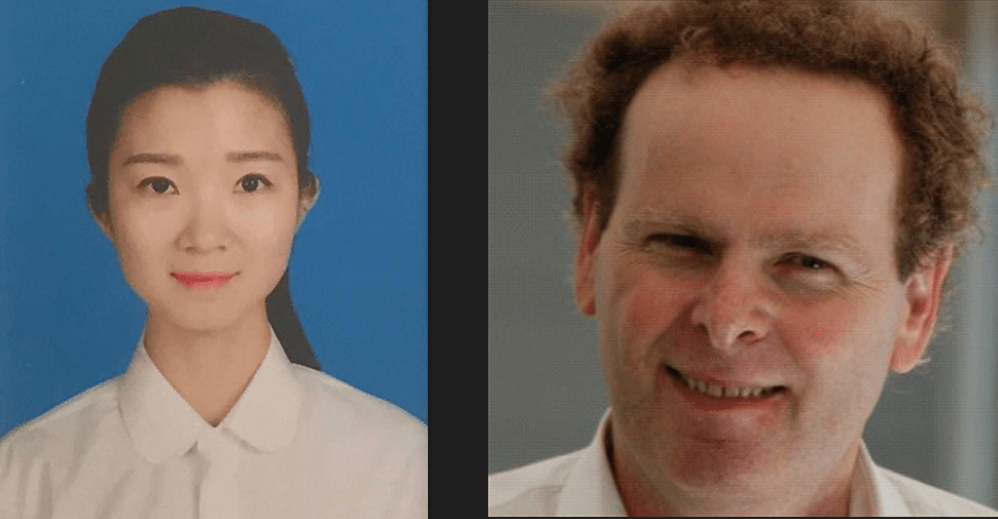

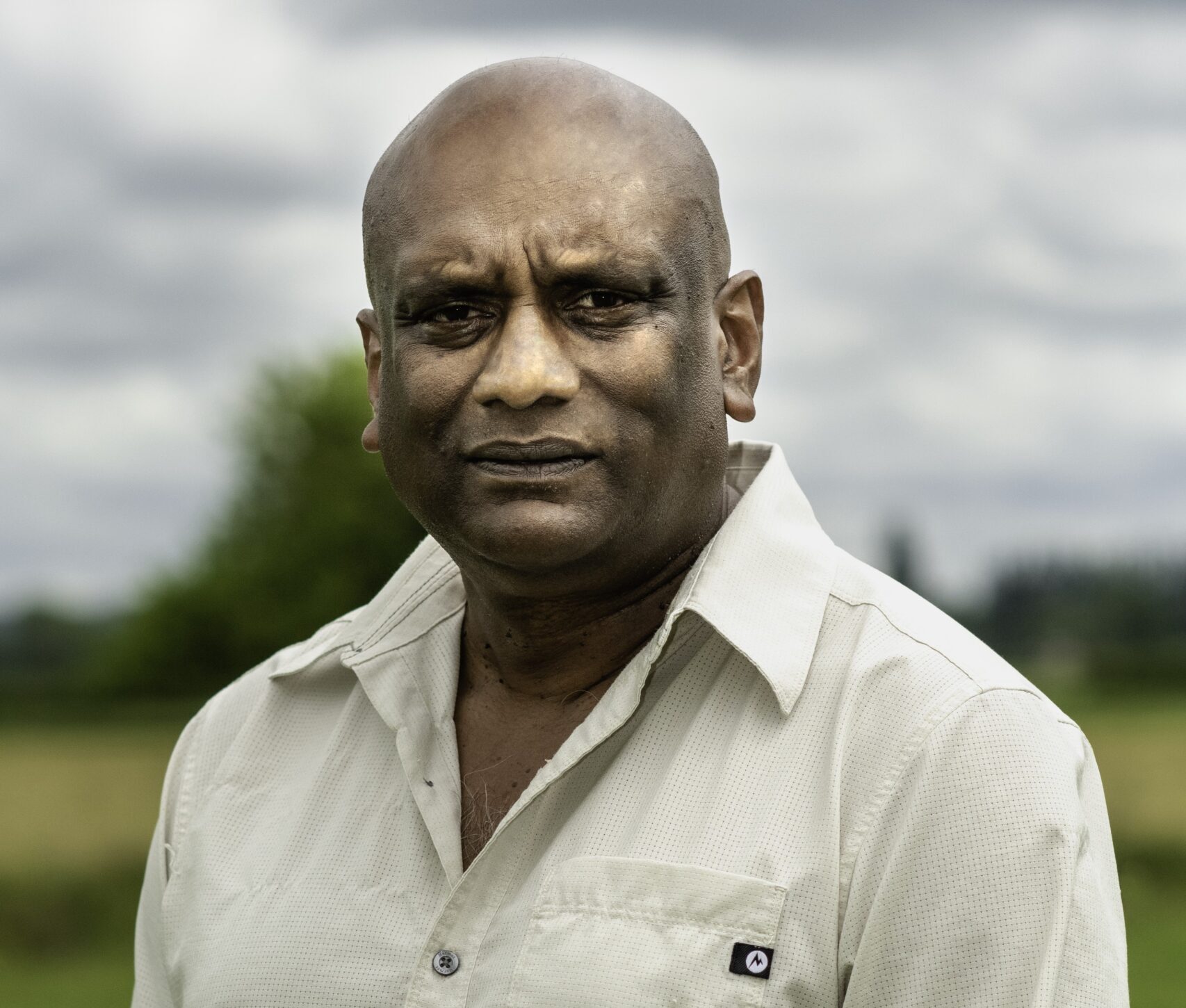

Your Go-To Waikato Insurance Broker Wayne Cooney Gets Cover for ALL

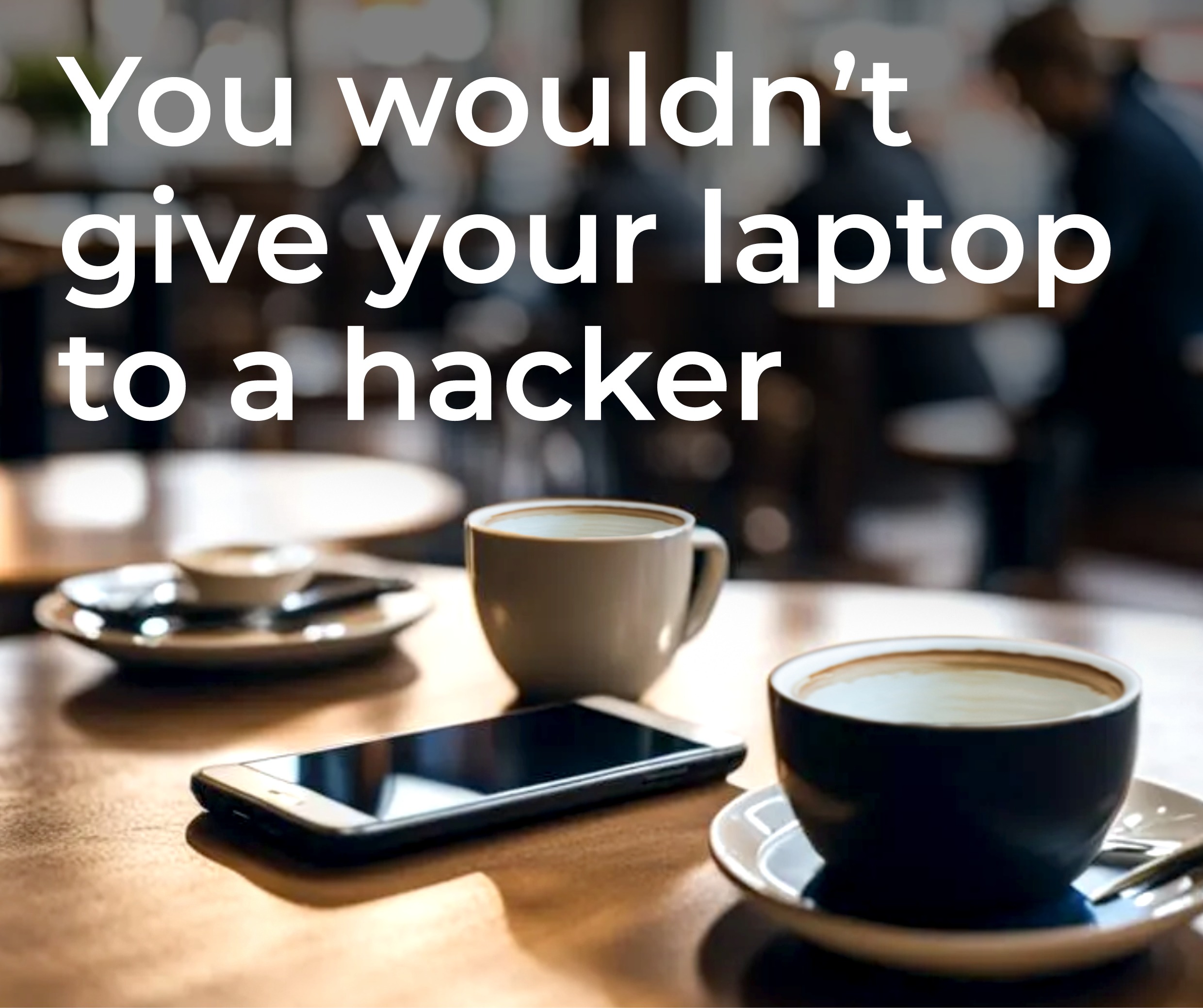

Small businesses in industries such as cafes/restaurants, hair salons/barbershops, bakeries, Web Designers/IT, gyms etc can benefit from an insurance broker. Insurance brokers act as valuable partners to help business owners protect their investments and navigate the complexities of insurance.

1. Customized Insurance Solutions:

Insurance brokers understand the unique risks associated with each industry. They work with business owners to assess their specific needs. Brokers leverage their industry knowledge to identify risks and design insurance packages that adequately cover property damage, liability claims, professional indemnity, employee compensation, and more.

2. Time and Cost Savings:

Insurance brokers can help small business owners with insurance-related matters, by handling policy research, comparisons, and negotiations. They use their network and relationships with insurance providers to secure competitive rates and coverage options, saving time and potentially reducing insurance costs.

3. Risk Management and Loss Prevention:

Insurance brokers collaborate with business owners to identify potential risks and develop risk management strategies. By conducting comprehensive risk assessments, implementing safety protocols, and providing guidance on preventive measures, brokers help mitigate potential losses. This approach may minimize business disruptions and can also lead to reduced insurance premiums.

4. Claims Advocacy:

Many brokers give support around claims along with the brilliant claims team behind them. They can guide them through the claims process, ensuring prompt and fair settlements. They have knowledge of policy terms and conditions and negotiate on behalf of their clients, helping them focus on their business, not on the claim.

5. Ongoing Support and Expertise:

The insurance landscape evolves, and policies need to be reviewed and adjusted to align with changing business needs. Insurance brokers provide support by regularly reviewing policies, identifying coverage gaps, and suggesting modifications to ensure small business owners have up-to-date insurance coverage.

Small business owners should partner with an insurance broker to access tailored insurance solutions, manage risks, receive claims advocacy, and receive ongoing support. This helps them focus on their passion and growth while having a comprehensive insurance plan in place.

Is your insurance due for renewal? Give Wayne Cooney your go-to insurance broker a call for a free quote or review today!

Contact Wayne Cooney

021 347 640

www.waynecooneyinsurancebroker.co.nz

facebook.com/waynecooneyinsurancebroker

Contact Phillip Quay

027 458 7724

facebook.com/nzbusinessconnect