UK Correspondent: Peter Minkoff

Artificial Intelligence changes industries one after another, and small businesses are at an edge. AI tools can automate tasks, analyse data, and improve customer service – just about anything is possible. However, the process of implementation itself is not that easy. For most small businesses around the world, embracing AI would amount to more than just getting on to the moving bandwagon but for mere survival and growth in a highly competitive digital marketplace. The following article endeavours to relate five major points showing the challenges and advantages of using AI technology amongst small companies.

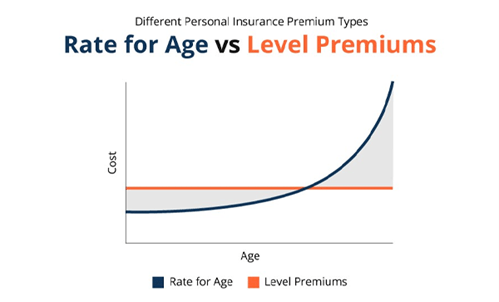

Financial Investment vs. ROI

The implementation of AI usually includes considerable financial investment, and for a small business, the return on this investment is a crucial factor. The prices for most AI solutions can be very high, especially in cases with involve analytics or automation, considering the capital constraint of a business. On the other hand, strategically implemented AI can yield long-term savings by optimising processes, reducing errors, and improving productivity. Customer support chatbots, for example, can answer simple questions at any time of day. This significantly reduces the need for a large support staff since an organisation will now be able to free up resources and invest them more diligently.

Enhanced Customer Experience through AI

Probably one of the most revolutionary influences of AI has to do with customer experience and support. AI helps small businesses to provide personalised experiences that largely are the domain of big enterprises. By availing themselves of predictive analytics, for instance, companies can be proactive in their anticipation of customer needs. Customer satisfaction thereby increases and ensures greater loyalty. AI chatbots and virtual assistants provide 24/7 support to customers, hence enabling smaller enterprises to compete with larger players by ensuring round-the-clock service. It would enable small businesses to strengthen customer relationships without necessarily increasing human resources, therefore giving them an edge over their competitors in customer service.

AI in Digital Marketing: Optimising Strategies

AI in digital marketing brings tools that enable small firms to compete on a relatively level playing field. AI-driven tools allow marketers to design better and more efficient campaigns more effortlessly and accurately, starting with audience segmentation and ad optimisation up to content creation and social media insights. While AI brings a wealth of data-driven insights to digital marketing, experienced agencies such as Four Dots are still crucial, especially for businesses needing tailored strategies. These agencies know the fine balance between human creativity and AI data a campaign requires to strike a chord with the target audience. Partnering with these agencies, small companies will maximise their digital presence while never losing that personal touch that’s often found with smaller brands.

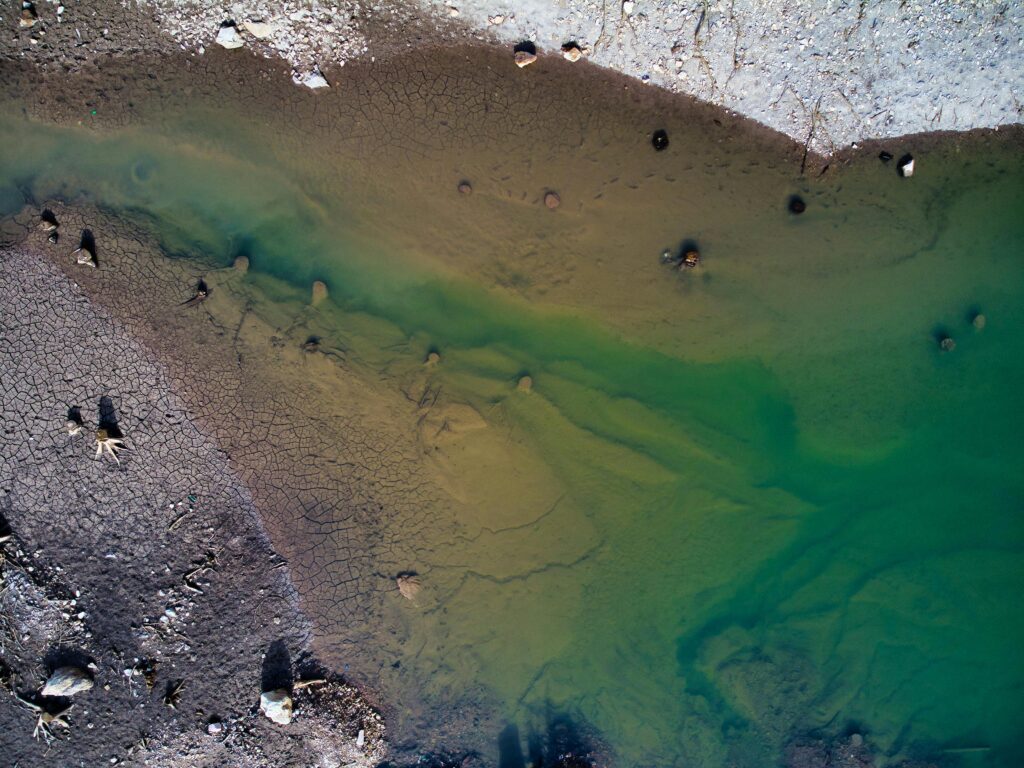

Data Security and Privacy Concerns

AI systems are extremely data-intensive, and this very aspect creates insecurities in terms of security and privacy, especially where small businesses may not necessarily have special cybersecurity measures in place. As small companies begin embarking on AI into their functionality, there also comes a view on risks related to data breaches and compliance issues. Severe data handling obligations under the GDPR and CCPA come with considerable fines for non-compliance. Therefore, small firms need to invest in not just AI but also cybersecurity measures that are good enough to protect sensitive information. Whatever the case may be, this domain is pretty intricate, where failure will come up with repercussions on reputational damage and loss of finance.

Skills Gap and Training Needs

AI technology is as good as the people implementing and managing it. Most small businesses are influenced by a shortage of skilled AI knowledge, as this new breed of tool requires specialised knowledge to fully understand and harness. The introduction of solutions with AI might require training for existing personnel or even the hiring of new personnel, adding to operational expenses. Fortunately, this can be supplemented through online courses, webinars, and collaboration with technology providers in upskilling the employees of small companies. Besides bringing out the fullest use of AI for business, investment in staff training provides the vital thread for innovation and continuous learning that should permeate each organisation interested in long-term growth.

In conclusion, AI promises transformative potential for small businesses, yet it is not a one-size-fits-all solution. It is only when comprehension and resolutions of these key insights are grasped that small companies can confidently navigate the integration of AI and position themselves for sustainable growth in the tech-driven world.

Contact MediaPA

027 458 7724

phillip@mediapa.co.nz